The booking fee is collected at RM300 or not exceeding 1% according to Hire Purchase Act (1967) of the cars On the Road (OTR) price.

The down payment is paid at 10% according to Hire Purchase Act (1967) of the cars On the Road (OTR) price.

Yes. You are entitled for a refund. However, a certain amount will be deducted from your refund to cover administrative fees as stated in the Vehicle Sales Order signed by you.

Place your request with the Sales Advisor to have your booking cancelled and to issue a cancellation letter, along with the original Vehicle Sales Order (VSO) and Official Receipt issued by the respective authorized Perodua Sales Outlet.

Interest rate range varies depending on the bank rates as regulated by Bank Negara.

The waiting period differs depending on variant/model. Please refer to the Sales Advisor for the precise time based on the variant/model requested.

The Perodua Online Booking is a web application for customers to book Perodua vehicle online through Perodua's official website.

Please visit our official Perodua website at www.perodua.com.my and click OUR MODELS menu. Then, follow step by step as per instructions.

No. The system wll not allow customers to to proceed with the second booking if the first booking has not been registered yet. You may liaise with your current Sales Advisor for the additional booking.

No. Perodua only allows one order per online booking submission. If you wish to book more than one vehicle, you may contact any Perodua Sales Advisor at the nearest outlet for more information.

Please visit our official Perodua website at https://www.perodua.com.my/ and click OUR MODELS menu. Then, follow step by step as per instructions.

A genuine Perodua Sales Advisor must have a unique QR code which is updated daily. You may request the Sales Advisor to share his/her QR code for your verification.

The available payment method for online booking is via the Financial Process Exchange (FPX).

You may pay the booking fee through FPX on Perodua’s official website. The booking fee is refundable and subject to the Terms & Conditions. Please liaise with your Sales Advisor if you wish to cancel the booking.

No, there will be no additional cost involved when you book your Perodua online.

Yes, you will receive an official receipt for the online transaction via email. You may also view your payment history on the UFIRST apps/portal after you register your membership.

Once booking is paid, you may log on to your UFIRST account to track your order and payment history.

Yes. Please tick YES for Trade-in, in the online booking form. Our Sales Advisor will make the necessary arrangement for your current vehicle.

i.Option 1 - You may directly apply for a loan via Perodua website once you have succeeded with booking payment; or

ii.Option 2 - You may liaise with your selected Sales Advisor for loan arrangement; or

iii.You may apply for loan via the UFIRST Apps/UFIRST portal upon signing the e-Vehicle Sales Ordering.

A bank officer will contact you for confirmation of loan application before proceeding with assessment for loan eligibility.

Yes, we use the FPX for a secured transaction, supported by multi-factor authentication through participating banks. Our website is also protected by SSL encryption, ensuring your personal and financial data is securely encrypted during transmission.

Estimation of delivery date will align with the waiting period at your selected outlet. You may liaise with your Sales Advisor on the expected delivery date.

You can also track your delivery status on our UFirst app/portal.

Yes, you may liaise with your Sales Advisor to change model, variant, color or GearUp packages. For confirmation of changes, you are required to acknowledge it on the UFIRST Apps/portal.

Yes, you can buy a car for your family members, friends or other person by entering details of the receiver in the online booking form.

Yes, the platform can be used for Malaysian or non-Malaysian, but registration and delivery of car must be done in Malaysia.

You may liaise with your Sales Advisor if you wish to cancel the booking. For confirmation of cancellation, you are required to acknowledge it on the UFIRST Apps/portal.

Vehicle Financing-i facility is a term financing which is calculated based on a fixed rate. Vehicle Financing-i allows you to own your dream vehicle under the contract of Murabahah (Murabahah to the Purchase Orderer "MPO").

The main shariah contract applied in the product is Murabahah (Murabahah to the Purchase Orderer "MPO") i.e a sale contract with a discloser of the asset cost price and profit margin to the purchaser (i.e the customer). Under this contract, there is an order and promise to purchase by the Customer prior to the seller (i.e the Bank)'s aquisition of the asset.

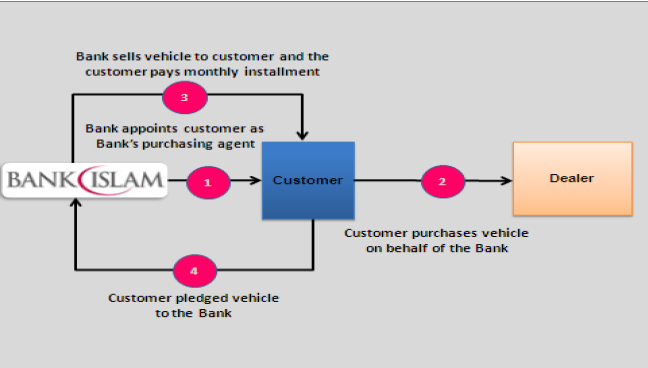

The mechanisme of the product is illustrated as follows:

1. Bank appoints the Customer as its Purchasing Agent to purchase the vehicle from the Dealer. Customer irrevocably and unconditionally promises (wa'd) and undertake to purchase the vehicle from the Bank.

2. The customer purchases the vehicle from the Dealer on behalf the Bank.

3. Bank sells the vehicle to the Customer on Murabahah basis. Customer pays the selling price to the Bank on deferred payment basis.

4. The Customer pledges the vehicle to the Bank as security/ collateral.

| Total Amount Financed | The margin of financing is up to 90% for standard application and up to 100% for special package i.e Vehicle Financing-i Gradhitz. The final financing amount approved will be based on the Bank's credit evaluation. | ||||

| Tenure | Tenure of financing is up to 9 years. | ||||

| Profit Rate | The fixed rates for Vehicle Financing-i:

|

Please note the above amounts and rates are indicative only. The final approved amount of your facility, tenure and profit rate is subject to Bank's approving criteria and may differ from the above.

| Monthly Payment Amount | The monthy payment is calculated in accordance to the formula below : Fixed Rate: ((P X R X T ) + P) / t , where : P = Financing Amount Approved R = Profit rate per annum T = Tenure of facility in years t = Tenure of facility in months |

Customer is obliged to pay the monthly payments until full settlement of the financing. Should the financing tenure be extended beyond the retirement age, the Customer is still obliged to pay the monthly payments. However, the customer may opt at any time to settle the financing in full.

Stamp duties (as per Stamp Act 1949 (Revised 1989)).

i. Without Guarantor RM20.00 (Letter of Offer RM10.00 and MPO Agreement RM10.00)

ii. With Guarantor RM30.00 (Letter of Offer RM10.00 and MPO Agreement RM20.00)

You are to pay the Bank all costs (if any) for the preparation and registeration of securities documents that have been incurred by the Bank in connection with the facility including the expenses incurred during the claim process if the Facility is cancelled.

Should you fail to fullfill your obligation in a timely manner, the following shall apply:

a. Breach of Wa'd

Customer to compensate the Bank for any actual loss incurred by the Bank due to customer's breach of promise (Wa'd) and undertaking to purchase the vehicle from the Bank.

b. Late Payment

The Bank shall imposed Ta'widh (compensation for late payment charge) to you as follows:

A sum equivalent to one per centum (1%) per annum on overdue installment(s) until day of full payment;

A sum equivalent to the prevailing daily overnight Islamic Interbank Money Market Rate on outstanding balance i.e outstanding Sales Price less ibra' (if any);

A sum equivalent to the prevailing daily overnight Islamic Interbank Money Rate on basic judgement sum calculated from judgment date until date of full payment.

Note: The imposition of Ta'widh shall be in such manner as approved by BNM.

c. Event of Default

In the event of Early Settlement of the financing, the Bank undertakes to grant customer to the Customer an Ibra' (rebate) which is equivalent to the Deferred Profit at the point of settlement.

Ibra' (rebate) Formula : Ibra' /rebate on early settlement = Deferred Profit.

Note:

i. Deferred Profit = Total Contracted Profit - Acrrued Profit.

ii. Total Contracted Profit = Bank's Selling Price - Bank's Purchase Price (or financing amount).

iii. Accrued Profit is calculated based on Profit Rate of the outstanding Bank's Purchase Price (for financing amount) being disbursed (or utilized).

Early Settlement:

"Early Settlement" means Settlement prior to the expiry of the Financing tenure by the Customer including, but is not limited to the following situations:

i. Customers who make an early settlement or early redemption, including those arising from prepayments;

ii. Settlement of the original Financing contract due to financing restructuring exercise;

iii. Settlement by Customers in the case of default;and/or

iv. Settlement by Customers in the event of termination or cancellation of Financing before the maturity date.

"Early Settlement Amount" means Outstanding Bank's Selling Price minus Ibra' on Early Settlement minus undisbursed (or unutilized) amount minus advances by the Customer plus temporary excess plus advances by the Bank plus ta'widh plus Early Settlement Charges".

Note:

i. Outstanding Bank's Selling Price = Outstanding Bank's Purchase Price (or Financing Amount) + Profit Overdue + Deferred Profit.

ii. Advances by the Bank which includes Takaful contribution/ insurance premium, legal fees, etc.

iii. Early Settlement Charges means actual costs allowed by Shariah Supervisory Council of the Bank.

Requirement for guarantor is applicable on case to case basis. The financed vehicle to be pledged as colleteral.

You are required to take up a comprehensive Motor Takaful/Insurance coverage on the vehicle financed for the entire financing tenure.

Optional - Auto Financing Takaful Plan (AFTP) which provides Takaful protection with the sum covered upon death or Total and Permanent Disability (TPD) of the person covered.

It is your responsibility and important for you to immediately inform us of any change in your contact details to ensure that all correspondences reach your in a timely manner.

If you have difficulties in making the monthly payments, you should contact us earliest possible to discuss the payment options. You may contact us at:

i. Contact Center Department,

Bank Islam Malaysia Berhad,

17th Floor, Menara Bank Islam,

No.22, Jalan Perak,

50450 Kuala Lumpur.

Tel: 03-2690 0900

Email: contactcenter@bankislam.com.my

ii. Visit our website www.bankislam.com.my for more details

Alternatively, you may seek the services of Agensi Kaunseling dan Pengurusan Kredit (AKPK), an agency established by Bank Negara Malaysia to provide free services and money management, credit counseling, financial education and debt restructuring for individuals.

You can contact AKPK at:

Tingkat 8, Maju Junction Mall,

1001, Jalan Sultan Ismail,

50250 Kuala Lumpur.

Tel: 03-2616 7766

Email: enquiry@akpk.org.my

If you wish to complaints on the products or services provided by us, you may contact us at:

Contact Center Department,

Bank Islam Malaysia Berhad,

17th Floor, Menara Bank Islam,

No.22, Jalan Perak,

50450 Kuala Lumpur.

Tel: 03-26 900 900

Fax: 03-2782 1337

Email: contactcenter@bankislam.com.my

If your query or complaint is not satisfactorily resolved by us, you may contact Bank Negara Malaysia LINK or TELELINK at:

Block D, Bank Negara Malaysia,

Jalan Dato' Onn,

50480 Kuala Lumpur.

Tel: 1-300-88-5465

Fax: 03-2174 1515

Email: bnmtelelink@bnm.gov.my

Superbike Financing-i

Vehicle Fiancing-i GradHitz

Whichever comes first. Please refer to Warranty and Service Booklet for more details.

No. You cannot claim the free service (labour) if you fail to service your vehicle on time. The free service shall only be applicable for vehicles which comply with the terms and conditions of the service stipulated in the Owner's Manual and Service Booklet.

For more details on the replacement of parts, kindly refer to our Service Booklet. You may also check with Perodua Authorised Service Centre.

We encourage you to perform periodical maintenance on time to avoid any safety issues and could void the vehicle's warranty policy.

The main differences are packaging and price. The packaging for Highstreet is in blue, while Service Centre has multi coloured packaging depending on the products. However, the formulation of the genuine oil for both market segments are similar. For more details, please refer to Perodua Genuine Oil page.

Yes. It comes in blue packaging available at Perodua Authorised Stockist. You may find the list of stockists at the bottom of Perodua Genuine Oil page. However, for better experience we encourage you to service your Perodua at a Perodua Authorised Service Centre.

You may contact our nearest service centre or make the appointment through Ufirst application (Selected Outlets).

We would advise to make your service appointment at least one week prior.

Please inform our Service Advisor in advance if you can't come on time.

Yes, it is possible to walk in; however, walk-in slots cannot be guaranteed and are subject to availability.

We are unable to schedule for major service repairs on Saturdays as they are peak days. However, if there are safety issues with your vehicle that need to be urgently addressed, we may be able to proceed with a service repair. This is done on a case-by-case basis.

Basic warranty coverage - 3 years or 100,000km (whichever comes first).

Major parts coverage - 5 years or 150,000km (whichever comes first).

For more details please refer to your Warranty and Service Booklet.

All parts (excluding naturally expendable parts and maintenance service parts) which are subject to Perodua warranty terms, conditions and limitations.

For warranty repair, the spare parts replacement depends on the vehicle's warranty period.

Yes. Please refer to Warranty and Service Booklet for detailed information on the exclusion of warranty and other situations which will render your warranty void.

Warranty will be void if any damage is caused by, or resulting from, any modification made to the vehicle. Please refer to Warranty and Service Booklet for detailed information on the exclusion of warranty and other situations which will render your warranty void.

Please refer to any Perodua Authorised Service Centre for more information.

Please note that the FAQs above are for general information only.

Should you require any further clarification, please contact one of our Perodua Outlets.

Perodua Outlets.